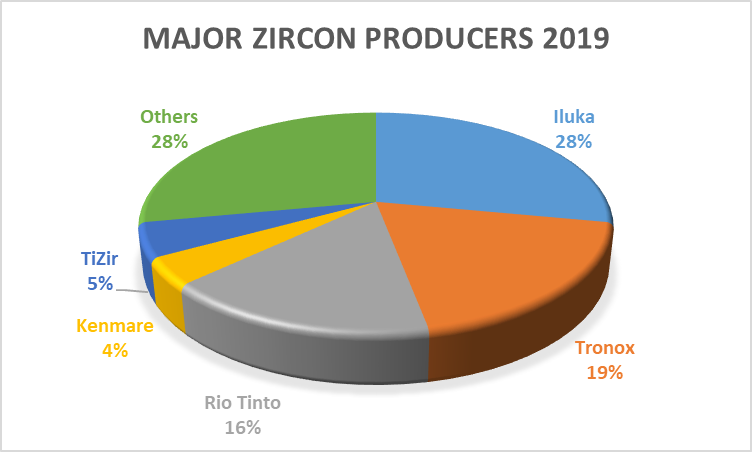

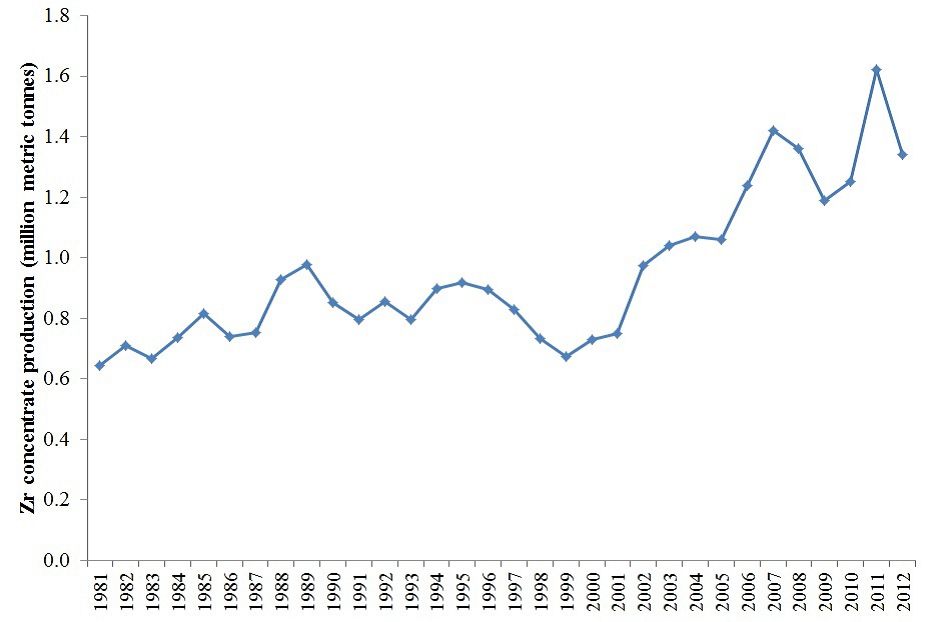

Zircon ResourcesZircon is believed to be the oldest existing mineral on our planet with zircons being formed at the beginning of the solar system some 4.5 billion years ago. It is the ability of zircon to withstand high temperatures and chemical attack that means they are found in some of the earliest rocks on our planet. The durability if Zircon means it remains in heavy sedimentary deposits such as beach sands. Zircon resources exceed 60 million tonnes with around 1.2 million tonnes mined per year. Zircon is typically mined as a by-product of titanium mining, ilmenite and rutile. Australia is the largest producer, supplying in the region of 40% of the global output, followed by South Africa at around 25%. The major producers are Iluka Resources, Richards Bay Minerals and Tronox/Cristal. These deposits are purified by spiral concentrators to remove the lighter materials which are returned to the deposit. The other heavy titanium minerals, rutile and ilmenite, are separated from the zircon by magnetic separation. Demand for titanium minerals has not increased as fast as that for zircon over the last decade, therefore producers have started to develop and exploit mineral sands deposits with higher zircon contents. Global Zircon Annual Production 2025 Global production of zircon sand in 2024 is in the region or 1.0-1.1m mts and is expected to be similar in 2025. The top 5 producers remain the same as the start of the decade; Iluka Resources, Tronox/Cristal, Rio Tinto RBM, Eramet TiZr and Kenmare Resources. Over the last year there have been a number of new entries into the market, including Sheffield Resources and Strandline Resources, who have contributed to the trend in Heavy Mineral Concentrate (HMC) being mined in Australia and then refined in China to produce Ilmenite and zircon. The new supply of HMC is expected to fill the gap left my some of the aging mines that will be reducing output over the coming years. However, there is still expected to be a supply deficit towards the end of the decade because up to 50% of the current supply is from mature mines. The current world zircon mine reserves show the dominance of Australian reserves with 68%, followed by South Africa with 11%, Mozambique 3% and both the USA and China with <1%. These figures suggest the likely ongoing trend of increased HMC mining in Australia and in the short and medium term the refining carried out in China. This is the preferred approach of new mining companies to minimise initial capital expenditure, generating revenues, before investing further in mineral processing capabilities. 2019

(source : Iluka)

1980 - 2012

|