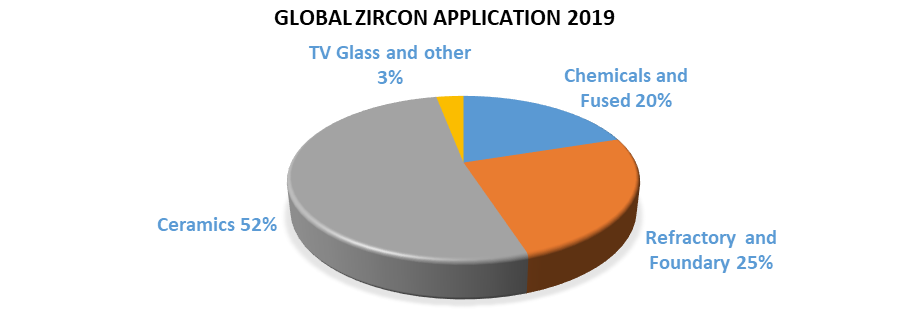

Zircon Market Outlook 2025 During 2024 the demand for zircon sand has been soft, mainly effected by the decline in the Chinese construction industry that accounts for 50% of the global zircon demand. The market has also seen the entry of 2 new Heavy Mineral Concentrate (HMC) suppliers during the last 12 months, which has led to a surplus of material. A trend over the last year has seen an increasing quantity of HMC being mined in Australia and shipped to China for refining to ilmenite and zircon. The price of premium grade (66%) zircon sand has remained just under USD 2000/mt over the last 12 months. The standard grade (65%) has started, and is finishing, the year around USD 1550/mt. The difference in price between the 2 grades has increased over the year due to a greater availability of the standard grade being refined in China. The medium term outlook for zircon continues to indicate a supply deficit beyond 2026 as mature operations, accounting for >50% of supply, start to decline their output and potentially close by the end of the decade. In the shorter term, during 2025, the market is expected to be similar to the last 12 months, with availability of material and pricing being stable. Zircon Market Update 2023 The global demand for zircon sand has been estimated at 1.2 million tonnes for both 2021 and 2022. This is a 20% increase over 2019 and 2020. The demand has been driven by India, China and Europe. and is expected to remain in 2023. With strong demand, as well as high freight rates, zircon started 2022 at USD 2000/mt and finished the year at USD 2300/mt CIF main China port for Iluka Resources sand. The strong demand is expected to stay for 2023 and so pricing will remain firm, with the potential to increase further by an estimated 10% during the year. The supply growth is limited even with Richards Bay Minerals returning to normal production and a number of new projects coming on stream. A number of aging mines are transitioning to lower grade ore bodies and therefore reducing output. Current demand remains firm in China, particularly in the ceramics industry as they move out of covid restrictions and the construction industry picks up. It is expected supply will remain quite tight during 2023 and further mine development is needed to meet future demand. As zircon sand is the starting raw material for the majority of zirconium chemicals and zirconium oxides, prices of these materials are expected to remain firm with upward pressure during 2023. Zirconium Market Update 2020 Zircon global demand The global demand for zircon sand in 2019 was 1.0Mtpa. The annual growth rate in demand has been around 1.5% for the last 5 years. This demand is forecast to increase to 2.7% from 2020-2023 (source : TZMI) Demand for zircon sand has been soft during the start of 2020 but this is thought to be short term and due to some global economic uncertainty and destocking of downstream supply chains. Solid long term fundamentals, such as increase in Asian and African middle classes and also continued urbanisation, are expected to drive demand going forward. Ceramics, such as tiles, sanitary ware amd table ware, are making up more that 50% of zircon sand consumption.

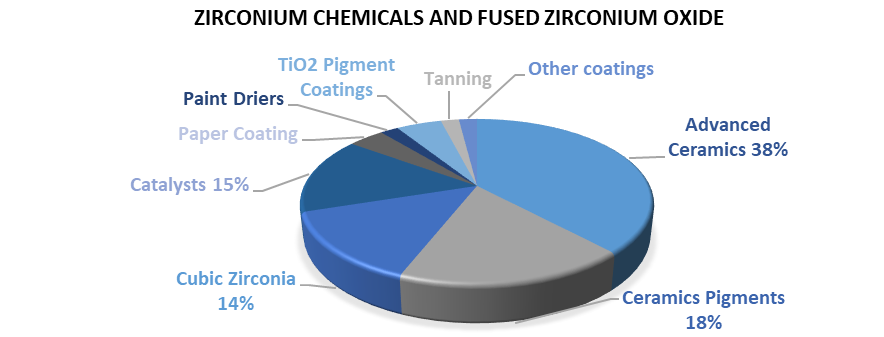

The zircon sand market value is in the region of USD 1.5B Zirconium Chemical and Fused Zirconium Oxide In 2019 the demand for zircon sand for the production of zirconium chemicals and fused zirconium oxide was in the region of 240ktpa which produced around 170ktpa of down stream products. China accounts for around 90% of global output of zirconium chemicals and zirconium oxide. The main zirconium chemicals produced are zirconium oxychloride, zirconium basic carbonate and zirconium oxide and they are used in the following applications:-

(source : Alkane)

The annual forecast growth in demand for zircon sand in the production of zirconium chemicals and fused zirconium oxide is expected to be 3-6% between 2020 and 2025. The estimated market value of these downstream zirconium chemicals and zirconium oxide was USD 2.0B in 2019. Zircon global supply

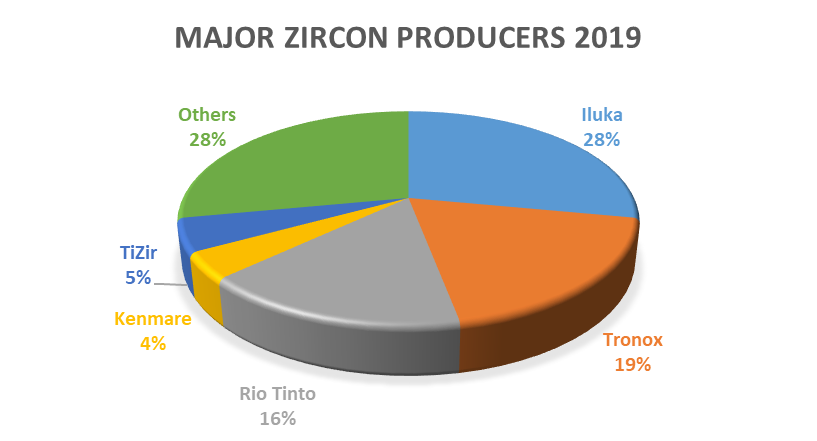

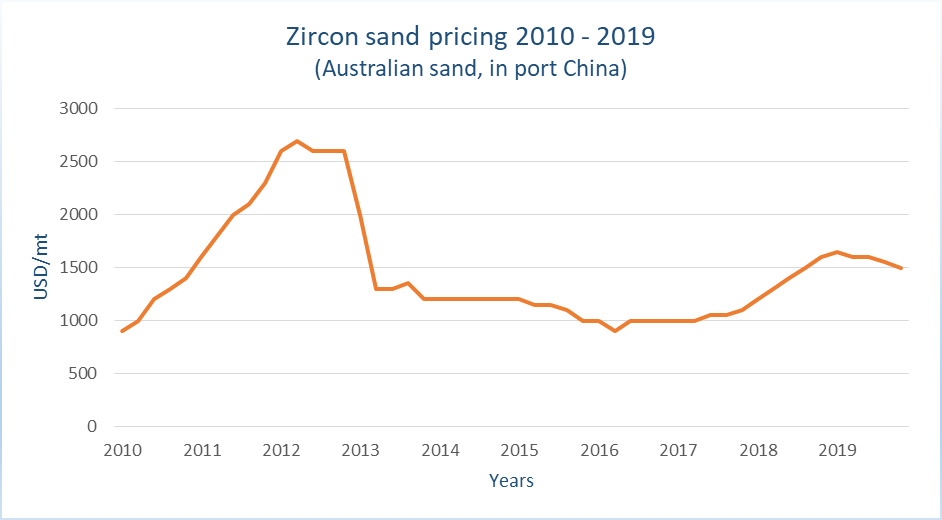

(source : Iluka) There is currently a general lack of quality mineral sand projects, particularly with high zircon assemblage, and a depletion of existing operations. The supply annual growth forecast for 2020-2025 is -3.6%. The market has broadly been in the balance during 2018/209 but the supply tipping point is expected in 2020 when we will move into a structural deficit going forward to 2025 and beyond. Even under subdued demand growth, less than the 2.7% forecast, there will be an expected deficit over the next 5 years (source : TZMI / Iluka) The issue with a supply shortage is the limited options for short term response, long lead times for new developments and the significant capital investment required to develop a new resource. The supply and demand imbalance over the coming years is likely to lead to an upward pressure on zirconium product pricing going forward. Zircon sand pricing In 2012 the price of zircon sand reached a peak of USD 2700/mt. This saw a subsequent drop off in demand in the following years as applications looked to substitute zircon with competing minerals or eliminate it totally from product formulations. Annual demand reduced from 1300ktpa in 2011 down to 1000ktpa in 2013. This drop off in demand led to the creation of large stockpiles which took a number of years to work through. Pricing during 203 to 2015 dropped back to levels of USD 1000-1200/mt. With steady growth in demand and reduced stockpiles, prices started increasing again in 2016 to 2019 to the current levels of USD 1500-1600/mt CIF China. Historic Zircon Sand pricing 2010-2019

With the forecast supply deficit for zircon starting in 2020 there is likley to be a firming up of prices during the first half of the year to around USD 1600/mt, with some increases towards the end of the year. With some increases in zircon prices during the year there will be a firming of zirconium chemical prices, including zirconium oxychloride, zirconium basic carbonate and zirconium oxide. Availability of raw material however for these products is not expected to be an issue. With any limit in availability the supply tends to be channelled to the higher value products, which includes the upstream chemicals. March 2020

Zirconium Market Update 2014 Zircon consumption is at its lowest point for a decade, having dropped by over 30% to 1Mt since its 2011 peak, but there are signs that demand in 2014 is set to stabilise. The use of zircon in some key markets, including traditional ceramics and foundries, has for several years been affected by substitution from competing minerals or its outright elimination from product formulations. This fall in consumption occurred in spite of continued growth in the traditional ceramics market, the largest application for zircon, as consumers sought to reduce their reliance on the opacifier mineral owing to high raw material costs. Zircon prices were volatile between 2010 and 2012, more than doubling in the space of 18 months to reach $2,500/t in mid-2012. This was the result of supply shortages, as end markets recovered from the financial downturn more rapidly than anticipated. In many cases, zircon consumers were unable to pass on increased costs, particularly in the traditional ceramics market. Substitution trends stabilise Lower consumption of zircon has been achieved by manufacturers through substitution, changing fashions and manufacturing innovations. In ceramics, zircon substitution has been particularly pronounced in the traditional Western European hubs of Spain and Italy. Ceramic producers have achieved similar quality levels by partially or completely substituting zircon with aluminosilicate minerals such as calcined alumina and feldspar in some applications. While some substitution has also been seen in Asian ceramics, mainly those produced for the export market, producers in the much larger domestic markets in the region have sacrificed quality in favour of lower production costs. In many cases consumers have entirely removed zircon from their formulations. As a result of lower zircon demand, supply significantly exceeded consumption which led to the creation of large stockpiles. During this period, prices stabilised and then fell sharply. Australian zircon export prices fell to an average of $1,650/t in late 2012, and continued to fall throughout 2013 and into 2014. By mid-2014, they had reached an average of $1,000/t. Zircon use in chemicals and refractories also showed a decline between 2011 and 2013, but this was linked to lower output of these end-products rather than raw material substitution. Downstream zirconium product demand picks up Zircon is used as the feedstock material in numerous downstream zirconium products, principally in the form of chemicals, zirconium oxide (zirconia) and metal. Zirconium products are used in myriad end markets, but typically in low-volume and high-value goods. World production of zirconium chemicals is dominated by China, where over 88% of capacity is located. Chinese companies have invested substantially in chemical facilities over the last decade, particularly for zirconium oxychloride which is the feedstock material for downstream zirconium chemicals. Global zirconium chemical capacity is estimated to be 523,000tpy in 2014, with zirconium oxychloride (ZOC) comprising 80% of this. The Chinese ZOC market is currently in a state of acute overcapacity with few profits available to suppliers. The largest market for zirconium oxychloride is now in the production of high-purity chemical zirconia, which itself is being influenced by the ceramic pigments market. The introduction of digital inkjet printing has revolutionised the decoration of ceramic tiles and has spurred demand for zirconia-based pigments. Ceramic pigments are also a major consumer of fused zirconia, although the dominant application for this material continues to be in refractory materials particularly for crude steel and glass manufacture. Advanced ceramics & environmental growth In the last three years the chemical zirconia market has seen healthy growth in the very high-value sectors of advanced ceramics and environmental markets, particularly bioceramic uses and oxygen sensors. Environmental markets have also spurred demand for zirconium basic carbonate and its derivative products, namely in the catalyst sector. Automotive catalyst demand is being driven by environmental concerns over the release of pollutants from automotive exhaust gases, which is prevented with the use of a catalytic converter. Over 95% of all new vehicles sold globally each year are now fitted with catalytic converters. The main influence on the zirconium metal market is the nuclear industry, accounting for around 60% of zirconium sponge capacity, where zirconium alloys are used in the manufacture of fuel tubes, cladding and other components. World demand and investments in nuclear power are recovering from the March 2011 Fukushima accident in Japan and its subsequent impact on global confidence in nuclear power safety. Price traction expected from 2016 World zircon demand is forecast to grow by 3.7%py between 2014 and 2019. The chemicals sector is expected to see the highest growth rate at 4.1%py, but will be closely followed by ceramics. Lower growth rates are projected for demand into the foundries and refractories sectors. Zircon prices are anticipated to be buoyed by higher demand and are forecast to stabilise in the latter part of 2014. While prices are expected to firm slightly in 2015, sizeable stockpiles currently overhang the market. These are likely to be drawn down until late 2015, after which higher sales and demand could encourage stronger prices. Roskill

|